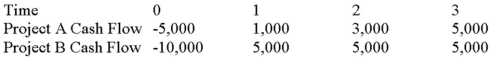

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Political Structure

The organization of government and the distribution of power within a society.

Gender Imbalance

A demographic disparity where the number of individuals of one gender significantly exceeds the number of individuals of the other gender within a population.

China

A country in East Asia, the world's most populous nation.

Development Aid

Financial aid given by governments and other agencies to support the economic, environmental, social, and political development of developing countries.

Q1: The study of the cognitive processes and

Q9: List and define the definitive set of

Q28: What is required to use the constant-growth

Q44: Your company faces a 34 percent tax

Q46: Compute the expected return given these three

Q62: If a firm has a cash cycle

Q75: MMK Cos.normally pays an annual dividend.The last

Q91: A company is considering two mutually exclusive

Q101: Which of the following approach for determining

Q109: An all-equity financed firm has $650 in