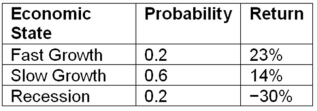

Compute the expected return given these three economic states,their likelihoods,and the potential returns:

Definitions:

Asset-specific Risk

The risk associated with an investment in a specific asset, which can result from factors unique to that asset, independent of the market.

Portfolio Diversification

Portfolio diversification is an investment strategy that aims to reduce risk by allocating investments among various financial instruments, industries, and other categories.

Security Market Line

A line that represents the relationship between the expected return of a security and its systematic risk, illustrating the risk-return trade-off in the capital asset pricing model (CAPM).

Q15: You have been asked by the president

Q24: Consider the following annual returns of Estee

Q29: What is the source of firm-specific risk?

Q52: Suppose your firm is considering two independent

Q56: Which of the following is another term

Q76: How do we define risk in this

Q77: Risk Premium The annual return on the

Q106: A firm uses only debt and equity

Q107: Portfolio Beta You own $2,000 of City

Q112: Which of the following is the asset