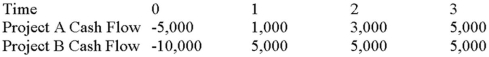

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Abbreviation

A shortened form of a word or phrase used to simplify written and verbal communication.

Pound

A unit of weight in the British imperial and the United States customary systems of measurement, equal to 16 ounces.

Lb

The abbreviation for pound, a unit of mass or weight in the British customary system of measurement.

Gram

A metric unit of mass equal to one-thousandth of a kilogram.

Q2: Which of the following would cause dividends

Q11: Suppose a firm pays total dividends of

Q15: ABC Inc.has a dividend yield equal to

Q32: A firm has retained earnings of $11

Q52: CM Enterprises estimates that it takes,on average,seven

Q67: You are trying to pick the least-expensive

Q78: All of the following capital budgeting tools

Q90: Which of the following is a checking

Q105: A graph of a project's _ is

Q107: Suppose a firm has a dividend payout