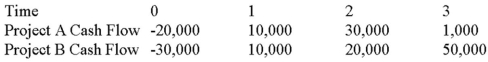

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Balanced Perspective

The ability to see all sides of a situation or argument without bias, ensuring a fair and rational assessment.

Axiological Arrest

Reduced level of morality that occurs if one fails to know, cherish, declare, act, and act habitually according to one’s values. Axiology is the branch of philosophy concerned with the study of values.

Adaptive Capacity

The ability of individuals or systems to adjust and cope with changes or challenges in their environment.

Cognitive Dissonance

Psychological discomfort experienced when attitudes and behavior are inconsistent.

Q11: Suppose that Dunn Industries has annual sales

Q19: Johnny Cake Ltd.has 10 million shares of

Q32: Which of the following will increase the

Q45: List and describe the three basic levels

Q60: KADS,Inc.,has spent $400,000 on research to develop

Q65: HiLo,Inc.,faces a 38 percent tax rate and

Q65: All of the following are incremental cash

Q97: Suppose your firm is considering two independent

Q100: The area of management concerned with designing

Q119: Compute the MIRR statistic for Project X