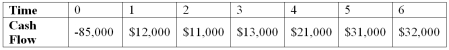

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and three and a half years,respectively.Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Sticky Wages

The tendency of nominal wages to adjust slowly to changes in the economy, such as inflation or unemployment, often leading to disequilibrium in the labor market.

Actual Price Level

The current average of all prices of goods and services in an economy, reflecting the purchasing power of money.

Quantity of Output

The total amount of a product or service that is produced by a company or an economy.

Short Run

A period in economics during which at least one factor of production is fixed, typically understood as a timeframe insufficient for adjusting all inputs.

Q6: Suppose a firm has a dividend payout

Q17: Portfolio Return Year-to-date,Company O had earned a

Q26: An all-equity firm is considering the projects

Q62: Portfolio Beta You hold the positions in

Q70: PNB Cos.has sales of $250,000 and cost

Q78: If a firm has a cash cycle

Q95: TellAll has 10 million shares of common

Q99: Fern has preferred stock selling for 95

Q115: Suppose your firm is considering investing in

Q117: Suppose your firm is considering two mutually