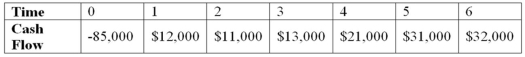

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Sample

A subset of a population selected for observation and analysis in order to make inferences about the entire population.

Well-written Hypothesis

A clearly formulated statement that makes a conjecture about the outcome of an experiment or research, specifying the expected relationship between variables.

Characteristics

Distinctive or identifying features or qualities of a person, object, or phenomenon.

Hypotheses

Proposed explanations made on the basis of limited evidence as starting points for further investigation.

Q10: Which of the following is the technique

Q17: Portfolio Return Year-to-date,Company O had earned a

Q20: Average Return The past five monthly returns

Q40: Year-to-date,Oracle had earned a 15.0 percent return.During

Q47: Suppose that Glamour Nails,Inc.'s capital structure features

Q47: Your firm needs a machine which costs

Q86: Marme Inc.has preferred stock selling for 137

Q100: Expected Return and Risk Compute the standard

Q109: When calculating operating cash flow for a

Q120: If the U.S.government increased the corporate tax