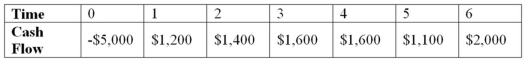

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Political Socialization

The process through which individuals acquire their political beliefs, values, and behaviors.

Authority on Politics

An expert or highly knowledgeable person in the field of political science or government affairs.

Political Values

Political values are the fundamental beliefs and principles that guide individuals and groups in their political behavior and decision-making, influencing their views on governance and policy.

Transfer

The act of moving something from one place, person, or ownership to another.

Q9: Suppose a firm has had the historical

Q11: Which of the following defines the term

Q37: Rings N Things Industries has 40 million

Q53: Dominant Portfolios Determine which one of these

Q55: Suppose your firm is considering investing in

Q56: Suppose your firm is considering investing in

Q63: Your company is considering a new project

Q74: Your company faces a 34 percent tax

Q89: Why might a firm announce a reverse

Q107: Suppose a firm has a dividend payout