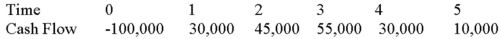

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the IRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

SteveNotes

Informal presentations or speeches given by the late Steve Jobs, co-founder of Apple Inc., typically introducing new products or technology developments.

Planned Parenthood v. Casey

A landmark 1992 United States Supreme Court case that reaffirmed the right to have an abortion while allowing states to impose certain restrictions.

Boris Yeltsin

A political leader who served as the first President of the Russian Federation from 1991 to 1999, playing a key role in the dissolution of the Soviet Union.

World Wide Web

A global network providing a wide range of information and communication facilities, consisting of interconnected networks using standardized communication protocols.

Q47: Which of these are sets of cash

Q54: A decrease in net working capital (NWC)is

Q55: Suppose that TV Industries,Inc.currently has the balance

Q64: Which type of bankruptcy involves a business

Q75: MMK Cos.normally pays an annual dividend.The last

Q77: What causes the change in optimal strategy

Q85: Suppose that Lil John Industries' equity is

Q91: A company is considering two mutually exclusive

Q108: Which of the following actions will cause

Q115: Suppose your firm is seeking a seven-year,amortizing