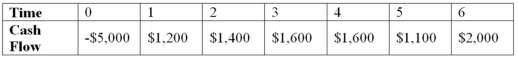

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years,respectively.Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Q1: Suppose a firm has a retention ratio

Q6: Suppose a firm has had the historical

Q17: Suppose your firm is considering investing in

Q41: Daddi Mac,Inc.,doesn't face any taxes and has

Q44: If you own 400 shares of Xerox

Q55: Your company is considering the purchase of

Q68: Portfolio Beta and Required Return You hold

Q83: Accelerated depreciation allows firms to:<br>A)receive less of

Q105: A graph of a project's _ is

Q107: When calculating operating cash flow for a