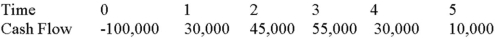

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistic for the project are three and three and a half years,respectively.

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Ovum

A female reproductive cell or egg that, when fertilized by a sperm, can develop into an embryo.

Spermatozoon

A male reproductive cell, or sperm cell, that carries a man's DNA to the female ovum.

Fallopian Tube

A pair of tubes along which eggs travel from the ovaries to the uterus.

Low-dose X-ray

Imaging technique that uses a small amount of ionizing radiation to produce pictures of the inside of the body.

Q12: A firm faces a 30 percent tax

Q39: You are evaluating a project for your

Q42: State the order claimants will be paid

Q51: You own $10,000 of Denny's Corp.stock that

Q55: Your company doesn't face any taxes and

Q62: Portfolio Beta You hold the positions in

Q71: Which of the following is the amount

Q87: No Nuns Cos.has a 20 percent tax

Q100: To correctly project cash flows,we need to

Q113: To compute and use the Equivalent Annual