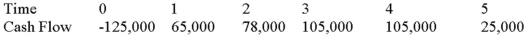

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.

Use the discounted payback decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Rural Freedmen

Former enslaved African Americans who lived in rural areas during the Reconstruction era in the United States, often working as sharecroppers or tenant farmers.

Freedmen's Bureau

An agency established by Congress in 1865 to assist freed slaves in the South during the Reconstruction era, providing food, housing, education, and legal aid.

Great Depression

The Great Depression was a severe worldwide economic downturn that lasted from 1929 to the late 1930s, marked by high unemployment, deflation, and a massive loss of global trade.

Social Policies

Guidelines and interventions by a government aimed at influencing societal welfare and well-being.

Q14: Your company has a 38 percent tax

Q23: Neither payback period nor discounted payback period

Q28: What must the rate be less than

Q42: What effect does increasing the standard deviation

Q43: Suppose your firm is considering investing in

Q49: Goldilochs Inc.reported sales of $8 million and

Q54: Suppose that Papa Bell Inc.'s equity is

Q59: Which of the following is a policy

Q61: Suppose that the 2013 actual and 2014

Q87: Which of the following is a repurchase