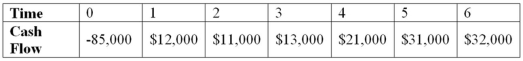

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the PI decision to evaluate this project; should it be accepted or rejected?

Definitions:

Retained Earnings

The portion of net income not distributed to shareholders but reserved by the company to reinvest in its core business or to pay debt.

Du Pont Identity

A financial analysis framework that breaks down Return on Equity (ROE) into three component parts—profit margin, asset turnover, and financial leverage—providing insights into a company's operational efficiency.

ROE

Return on Equity, an indicator of financial efficiency determined by dividing the net income by the equity of shareholders.

Q4: Which of the following would cause dividends

Q16: Suppose that Wind Em Corp.currently has the

Q20: Suppose that the 2013 actual and 2014

Q53: For a project with normal cash flows,what

Q60: The level of EBIT at which EPS

Q87: Compute the MIRR statistic for Project I

Q94: Suppose your firm is considering investing in

Q99: Suppose a firm has a dividend payout

Q104: Suppose that Tucker Industries has annual sales

Q113: An all-equity firm is considering the projects