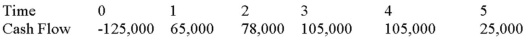

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.

Use the MIRR decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Goodwill

The expected continuance of public patronage of a business.

Ethical System

A set of principles or guidelines designed to direct individual or collective behavior towards moral and ethical decision-making.

Motor Oil

A lubricant used in internal combustion engines to reduce wear and clean the engine from sludge and varnish.

Julia

A high-level, high-performance dynamic programming language designed primarily for technical and scientific computing.

Q12: A firm has 1,000,000 shares of common

Q15: What might happen when managers use a

Q52: CM Enterprises estimates that it takes,on average,seven

Q62: How is the initial investment adjusted for

Q75: Section 179 allows a business,with certain restrictions,to

Q78: ABC Engineering just purchased a new machine.All

Q90: JEN Corp.is expected to pay a dividend

Q92: Which of the following is defined as

Q104: Effects that arise from a new product

Q116: The mix of debt and equity that