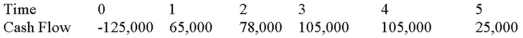

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 12 percent,and that the maximum allowable payback and discounted payback statistic for the project are two and two and a half years,respectively.

Use the NPV decision rule to evaluate this project; should it be accepted or rejected?

Definitions:

Q20: PBJ Enterprises estimates that it takes,on average,three

Q26: Standard Deviation The standard deviation of the

Q49: Your company doesn't face any taxes and

Q57: BOGO Shoes would like to maintain their

Q58: CM Enterprises estimates that it takes,on average,seven

Q68: Would a firm ever use short-term debt

Q72: Suppose that Runner Industries currently has the

Q80: Suppose you have a project whose discounted

Q114: Compute the NPV for Project X and

Q122: Suppose you sell a fixed asset for