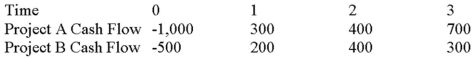

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the discounted payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Market Extension Merger

A merger between companies in similar industries but different markets, aimed at expanding the market reach of products or services.

Federal Trade Commission

An independent agency of the United States government tasked with promoting consumer protection and eliminating and preventing anticompetitive business practices.

Antitrust Claims

Legal allegations related to the violation of antitrust laws, aiming to promote competition and protect consumers from monopolistic practices.

Clayton Act

The Clayton Act is a U.S. antitrust law, enacted in 1914, aimed at preventing anticompetitive practices and promoting fair competition.

Q4: TAFKAP Industries has 8 million shares of

Q8: Risk Premiums You own $5,000 of Software

Q35: Suppose a firm has had the historical

Q58: CM Enterprises estimates that it takes,on average,seven

Q65: ADK Industries common shares sell for $40

Q66: On the _,the firm will look on

Q67: Expected Return A company's current stock price

Q96: Which of the following statements is correct?<br>A)If

Q97: You are evaluating a product for your

Q113: All of the following capital budgeting tools