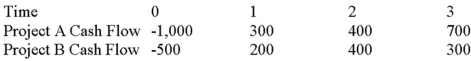

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Prospective Capacity

Refers to the expected or future ability of a company or economy to produce goods or services.

Common Size Balance Sheet

A financial statement that presents all items as percentages of a common base figure, such as total assets, facilitating comparison across time and companies.

Total Assets

The sum of all assets owned by an entity, encompassing both current and non-current assets, and used in determining a company's financial health.

Owners' Equity

The residual interest in the assets of the enterprise after deducting liabilities, representing the owner's claim against the company's resources.

Q16: When we adjust the WACC to reflect

Q18: How might a small market risk premium

Q43: Which of the following statements is true?<br>A)If

Q72: Which of these is an entity who

Q81: Which of the following is when the

Q99: Average Return The past five monthly returns

Q103: Portfolio Return At the beginning of the

Q105: A graph of a project's _ is

Q108: Which of the following actions will cause

Q117: Define subjective and objective approaches to divisional