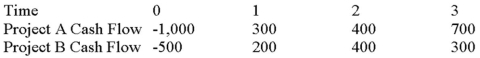

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 10 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three and a half years,respectively.

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Desired Amount

The specific quantity of money or resources that an individual or organization aims to achieve or accumulate.

Management Support

Refers to the assistance and resources provided by a company's management to support the operations, strategies, and objectives of the business.

Actual Results

The real, as opposed to projected or forecasted, outcomes of financial activity within a specific period.

Quarterly Sales

The total revenue generated from sales within a specific three-month period in a fiscal year.

Q1: Which of the following is likely to

Q6: If a firm has a cash cycle

Q19: Johnny Cake Ltd.has 10 million shares of

Q24: Which of the following is a situation

Q27: A firm has retained earnings of $11

Q31: Which of the following is a reason

Q46: Which of the following is defined as

Q88: Suppose a firm has had the historical

Q94: Your firm needs a machine which costs

Q132: List and explain the "five C's" of