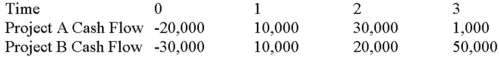

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the payback decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

French Executive

A high-ranking business leader or administrator within a company, based in France or of French nationality.

Cultural Intelligence

The ability to relate to and work effectively across cultures.

Cultural Savvy

The ability to understand and appreciate the nuances of different cultures, often leading to more effective communication and interactions.

Pocket Translators

Portable electronic devices or applications designed to translate text or spoken words from one language to another in real-time.

Q3: Which of the following statements is correct

Q10: Which of the following are considered "chunky"

Q12: A firm has 1,000,000 shares of common

Q35: Which of the following is the tendency

Q63: Which of the following statements is correct?<br>A)The

Q64: Which type of bankruptcy involves a business

Q105: An estimated WACC computed using some sort

Q107: Portfolio Beta You own $2,000 of City

Q113: Praxair's upcoming dividend is expected to be

Q114: All else the same,firms with stable,predictable income