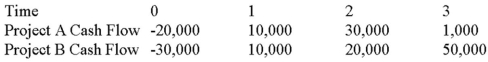

Suppose your firm is considering two mutually exclusive,required projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 8 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and three years,respectively.

Use the IRR decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Chief Complaint

The primary symptom or concern that leads a patient to seek medical attention or care.

Present Illness

A comprehensive account focusing on the current illness or medical condition affecting a patient, detailing the onset, progression, and symptoms.

Past History

A record of an individual's past medical conditions, surgeries, treatments, and responses, important for informing current healthcare decisions.

Communication Technique

Strategies or methods used to convey information, ideas, or feelings effectively to others.

Q1: The study of the cognitive processes and

Q2: How does profitability index differ from the

Q9: Suppose that Hanna Nails,Inc.'s capital structure features

Q26: What will happen to the price of

Q52: To find the percentage return of an

Q60: An all-equity firm is considering the projects

Q66: Which of these are fees paid by

Q89: Explain when it is appropriate to use

Q99: Fern has preferred stock selling for 95

Q108: GBH Inc.is planning on announcing a 2-for-5