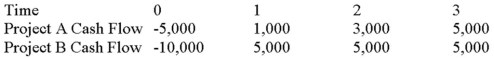

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Economies of Scale

The cost advantages that enterprises obtain due to their scale of operation, resulting in cost per unit of output decreasing with increasing scale.

3-D Printers

Technology that creates three-dimensional objects from digital models by layering materials.

Explicit Costs

The direct payment costs to others in the course of running a business or undertaking an economic transaction.

Implicit Costs

Costs that represent forgone opportunities, often not directly outlaid but incurred when resources are used for one purpose over another.

Q12: A firm faces a 30 percent tax

Q13: Which of the following is a reason

Q44: ABC Engineering just bought a new machine.All

Q47: Suppose that Team Industries,Inc.currently has the balance

Q57: BOGO Shoes would like to maintain their

Q72: Suppose you sell a fixed asset for

Q86: Suppose your firm is considering two mutually

Q99: The operating cycle will increase with all

Q104: Suppose your firm is considering investing in

Q106: Risk versus Return Rank the following three