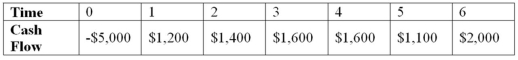

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Delusions

Strongly held beliefs that are contradicted by reality, often seen in psychiatric conditions such as schizophrenia.

Hallucinations

Perceptions in a conscious and awake state in the absence of external stimuli, which have qualities of real perception.

Mental Illness

An extensive variety of psychiatric conditions impacting emotional state, thought processes, and behavior.

Hippocrates

Known as the "Father of Medicine," an ancient Greek physician who established a medical school and is credited with developing the Hippocratic Oath for physicians.

Q10: Which of the following are considered "chunky"

Q15: Would it be worth it to incur

Q39: Suppose your firm is considering investing in

Q40: What would be the appropriate way to

Q43: Your company doesn't face any taxes and

Q52: CM Enterprises estimates that it takes,on average,seven

Q70: Compute the MIRR statistic for Project J

Q94: You obtain beta estimates of General Electric

Q101: Your company doesn't face any taxes and

Q114: JaiLai Cos.stock has a beta of 1.7,the