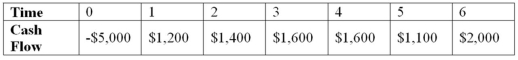

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 8 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Hot Saucepan

A cooking utensil that becomes heated when used on a stove, requiring caution to avoid burns.

Merchant Ship

A vessel that transports cargo or passengers for hire in commerce across marine waters.

Drowned

The state of dying from submersion in and inhalation of water or another liquid.

Anaphylactic Shock

A severe, potentially life-threatening allergic reaction causing widespread vasodilation, drop in blood pressure, and airway obstruction.

Q14: If a firm has a cash cycle

Q31: Suppose a firm has had the historical

Q33: A firm uses only debt and equity

Q57: Which of the following is defined as

Q59: Articulate the rationale of the additional funds

Q59: Which of these is the line on

Q59: Due to rapid growth,a computer superstore is

Q90: Stock Market Bubble If the NASDAQ stock

Q94: Your firm needs a machine which costs

Q123: Which of these is the concept that