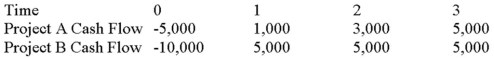

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the PI decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Self-Esteem

An individual's subjective evaluation of their own worth, including beliefs about oneself.

Object Relations

A school of psychodynamic thought that emphasizes the real (as opposed to fantasized) relations an individual has with others.

Conditional Positive Regard

Acceptance and love that are contingent upon a person's behaving in certain ways or meeting certain conditions.

Self-Actualization

According to Abraham Maslow and some other adherents of the humanistic approach to personality, the full realization of one’s potential.

Q5: Which of the following actions will cause

Q15: Your company has a 40 percent tax

Q22: Which of the following is typically considered

Q24: Which of the following is a situation

Q29: The MIRR statistic is different from the

Q37: Define the Modigliani-Miller (M&M)theorem and list the

Q60: How might a large market risk premium

Q72: An all-equity financed firm has $450 in

Q74: Which of the following statements is correct?<br>A)Generally

Q83: The inventory order quantity that minimizes total