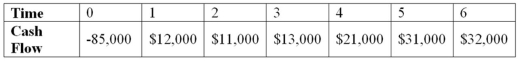

Suppose your firm is considering investing in a project with the cash flows shown as follows,that the required rate of return on projects of this risk class is 10 percent,and that the maximum allowable payback and discounted payback statistics for the project are three and a half and four and a half years,respectively.Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Superego

Part of the human psyche, according to Freudian theory, that represents internalized ideals and provides standards for judgment (the conscience) and for future aspirations.

Collective Unconscious

A concept proposed by Carl Jung that refers to the part of the unconscious mind which is derived from ancestral memory and experience and is common to all humankind.

Personal Unconscious

A component of Jung’s analytical psychology, referring to all information that is present within an individual's mind, but not readily accessible to immediate consciousness.

Carl Jung

A Swiss psychiatrist and psychoanalyst who founded analytical psychology and contributed to the understanding of the psyche, archetypes, and the collective unconscious.

Q21: Your company is considering a new project

Q24: If a firm starts selling its accounts

Q51: Suppose your firm is considering two mutually

Q58: Why do we use market-value weights instead

Q61: Diddy Corp.stock has a beta of 1.0,the

Q63: Your company is considering a new project

Q74: Define and evaluate the net present value

Q92: U.S.Bancorp holds a press conference to announce

Q106: Which of the following is a short-term

Q111: Risk Premium The annual return on the