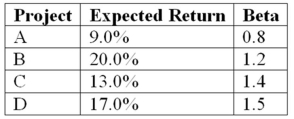

An all-equity firm is considering the projects shown as follows.The T-bill rate is 3 percent and the market risk premium is 6 percent.If the firm uses its current WACC of 12 percent to evaluate these projects,which project(s) ,if any,will be incorrectly rejected?

Definitions:

Call Girl

A sex worker who provides services to clients, often after being contacted by telephone or the internet, as opposed to working in public places.

Sex Worker

An individual who engages in sexual activities in exchange for money or other forms of payment.

Sexual Services

Activities that involve providing sexual pleasure in exchange for compensation.

Sexually Explicit

Content or material that openly and directly expresses or deals with sex and sexual activities.

Q7: All of the following can be included

Q10: Which of the following is the technique

Q10: Expected Return and Risk Compute the standard

Q34: Which of these is the reward for

Q52: CM Enterprises estimates that it takes,on average,seven

Q55: A stock is expected to pay a

Q70: Buying Stock with a Market Order You

Q80: Which of the following statements is correct

Q84: Suppose your firm is considering two independent

Q99: Which of the following measures the operating