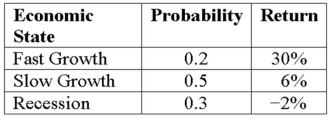

Expected Return Risk Compute the standard deviation of the expected return given these three economic states,their likelihoods,and the potential returns:

Definitions:

Equity Method

An accounting technique used by companies to record their investments in other companies, where the investment gives the investor significant influence over the investee, but not control or full ownership.

Additional Paid-in Capital

The excess amount over the par value that shareholders pay when shares are issued, recorded in the equity section of the balance sheet.

Consolidated Earnings Per Share

A measure of a company's profitability that takes into account earnings from all of the entities it controls, presented on a per-share basis.

Q1: Future Value Compute the future value in

Q10: We often use the P/E ratio model

Q35: Company Risk Premium A company has a

Q46: Suppose your firm is considering investing in

Q50: Whenever a set of stock prices go

Q62: Portfolio Beta You hold the positions in

Q118: Future Value Given a 4 percent interest

Q118: Your firm needs a computerized machine tool

Q122: A 6.75 percent coupon bond with 13

Q144: Future Value Compute the future value in