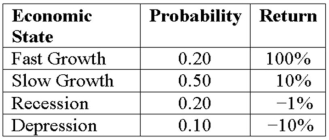

Expected Return and Risk Compute the standard deviation given these four economic states,their likelihoods,and the potential returns:

Definitions:

Capital Needs

The financial requirements a company has for carrying out its operations and investments, including the purchasing of assets and funding of projects.

Par Value

The nominal or face value of a bond, share of stock, or coupon as stated by the issuer.

Paid-In Capital

The amount of money that a company has received from shareholders in exchange for shares of stock.

Retained Earnings

The portion of net profits that are kept in the company rather than distributed to shareholders as dividends, often used for reinvestment in the business.

Q15: What might happen when managers use a

Q33: A manufacturing firm is planning on expanding

Q33: If a firm's inventory ratio increases,what will

Q39: Loan amortization schedules show:<br>A)the principal balance paid

Q46: Compute the expected return given these three

Q87: Call Premium A 5.5 percent corporate coupon

Q93: What effect does decreasing the standard deviation

Q108: TJ Co.stock has a beta of 1.45,the

Q113: To compute and use the Equivalent Annual

Q122: A 6.75 percent coupon bond with 13