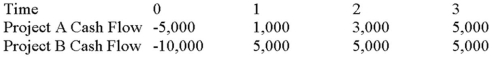

Suppose your firm is considering two independent projects with the cash flows shown as follows.The required rate of return on projects of both of their risk class is 12 percent,and the maximum allowable payback and discounted payback statistic for the projects are two and a half and three years,respectively.

Use the NPV decision rule to evaluate these projects; which one(s) should be accepted or rejected?

Definitions:

Raw Materials

The basic substances used in the production of goods, often extracted from the earth.

Custom Made

Products or services specifically tailored to meet the individual needs or preferences of a client.

Raw Materials

The fundamental substances used in the production of goods, typically natural resources or agricultural products.

Widget Producer

A generic term often used to describe a manufacturer that specializes in producing a non-specific, often hypothetical, item or product.

Q16: When we adjust the WACC to reflect

Q46: Suppose your firm is considering investing in

Q60: Suppose a firm was planning to greatly

Q71: Land O Lakes Systems has a beta

Q85: Suppose that a firm always announces a

Q96: Which of the following describes the place

Q98: A firm may keep part of its

Q106: Suppose your firm is considering two mutually

Q109: Suppose your firm is considering investing in

Q110: We use the term leverage to describe