Use the information for the question(s) below.

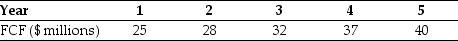

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-If CCM has $200 million of debt and 8 million shares of stock outstanding,then the share price for CCM is closest to:

Definitions:

Stated Value

The value assigned to no-par-value stock by the board of directors of a company, which can then be used as the basis for accounting and legal purposes.

Dividends in Arrears

Unpaid dividends on cumulative preferred stock, which must be paid out before any dividends can be issued on common shares.

Cumulative Preferred Stockholders

Investors holding a type of preferred stock that accumulates dividends in arrears should the dividends not be declared in any given period.

Non-Participating

Refers to insurance policies or investment products that do not provide dividends or bonuses to policyholders or investors.

Q2: Safety Products currently outsources an electrical switch

Q2: Which of the following statements is FALSE?<br>A)

Q2: What do you anticipate will happen to

Q5: Consider a bond that pays annually an

Q43: If you hold this bond to maturity,

Q52: Jacob is a department manager who recently

Q55: The price (expressed as a percentage of

Q64: The following income statement is provided for

Q65: When choosing between projects, an alternative to

Q75: The NPV for Galt Motors of manufacturing