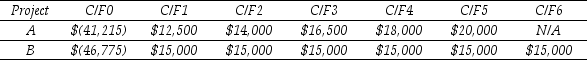

Use the table for the question(s) below.

Consider two mutually exclusive projects with the following cash flows:

-You are considering using the incremental IRR approach to decide between the two mutually exclusive projects A & B.How many potential incremental IRRs could there be?

Definitions:

Act with Integrity

Conducting oneself according to moral and ethical principles, being honest and having strong moral uprightness.

Stakeholder Pressures

The demands or expectations placed on an organization by individuals or groups with an interest in its activities.

Groups of People

Collections of individuals who come together based on common interests, goals, or characteristics.

Concerns

issues or matters that require attention or worry, often prompting individuals or organizations to take action or make decisions.

Q20: Suppose a risky security pays an average

Q30: If the risk-free interest rate is 10%,

Q33: Which of the following statements is FALSE?<br>A)

Q42: You are in the process of purchasing

Q45: A three-month treasury bill sold for a

Q63: A cost variance is unfavorable if actual

Q64: The change in Net working capital from

Q70: Suppose that you are considering an investment

Q80: Assuming that your capital is constrained, what

Q81: If the appropriate discount rate for this