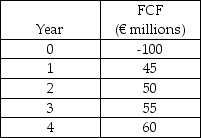

Use the following information to answer the question(s) below.

Hammond Motors is considering an investment in the Euro area.The expected free cash flows,in euros,are uncorrelated with the spot exchange rate and are as follows:  The new project,which Hammond is considering,has similar dollar risk to Hammond's other projects.Hammond knows that its overall dollar WACC is 10%,so it feels comfortable using this WACC for the project.The risk-free interest rate on dollars is 4% and the risk-free interest rate on euros is 6%.Hammond is willing to assume that capital markets in the United States and the Euro area are internationally integrated.

The new project,which Hammond is considering,has similar dollar risk to Hammond's other projects.Hammond knows that its overall dollar WACC is 10%,so it feels comfortable using this WACC for the project.The risk-free interest rate on dollars is 4% and the risk-free interest rate on euros is 6%.Hammond is willing to assume that capital markets in the United States and the Euro area are internationally integrated.

-Hammond's Euro WACC is closest to:

Definitions:

Q8: The permanent working capital needs for Hasbeen

Q9: The Rufus Corporation has 125 million shares

Q12: Assuming that Novartis AG (NVS) has an

Q25: When a company analyzes its short-term financing

Q35: What is a white knight?

Q40: The Internal Rate of return of this

Q43: Which of the following statements is FALSE?<br>A)

Q51: The payback period for project A is

Q68: Consider an ETF that is made up

Q77: Consider a zero-coupon bond with a $1000