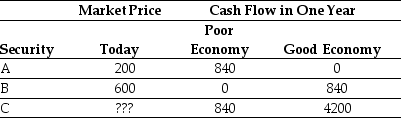

Use the table for the question(s)below.

-Suppose that security C had a risk premium of 30%,describe what arbitrage opportunity exists and how you would exploit it.

Definitions:

In The Money

A term used in options trading to describe a situation where an option has intrinsic value, indicating a favorable position.

Employee Stock Option (ESO)

A benefit given to employees which grants them the right to purchase shares of the company at a specified price after a certain period.

Call Options

Financial contracts giving the option buyer the right, but not the obligation, to buy a stock, bond, commodity, or other assets at a specified price within a specific time period.

Q2: Which of the following statements is FALSE?<br>A)

Q11: What kind of corporate debt has a

Q14: The Black-Scholes value of a one-year call

Q24: Assuming you get 50% control of Associated

Q29: Suppose the interest rate on Russian government

Q39: Which of the four bonds is the

Q40: Calculate the monthly lease payments for a

Q46: Rearden Metal has borrowed $4 million for

Q54: If the current rate of interest is

Q56: If the discount rate is 15%, the