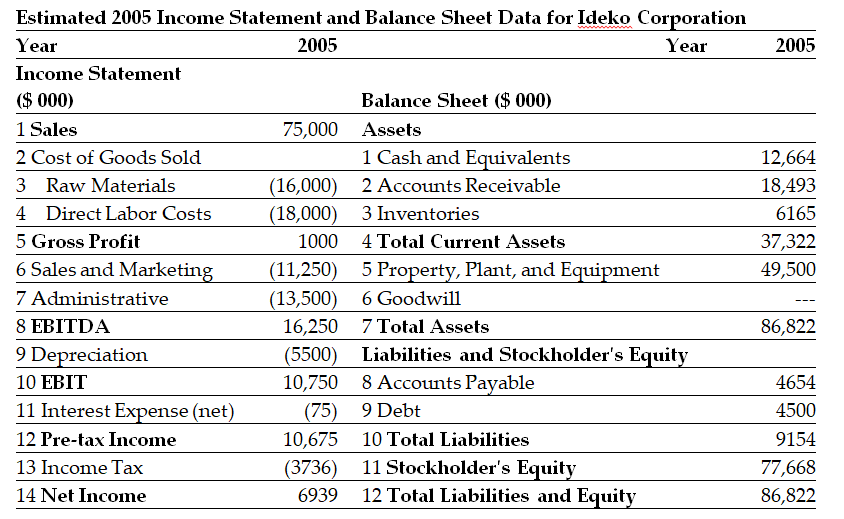

Use the tables for the question(s) below.

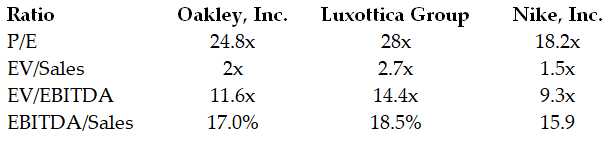

The following are financial ratios for three comparable companies:

-Based upon the average EV/Sales ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

Definitions:

Motivation

The reason or reasons one has for acting or behaving in a particular way.

Routine Jobs

Jobs that involve repetitive tasks and require minimal creativity or problem-solving skills.

Recognition

The acknowledgment or appreciation of an individual's achievements or qualities, often used as a motivational factor in various contexts.

Full Potential

The highest level of performance or achievement that an individual is capable of reaching.

Q3: Rearden Metal has just issued a callable,

Q5: Assuming that Rearden's annual lease payments are

Q5: In 2005, assuming an average dividend payout

Q24: Assuming that Rearden's annual lease payments are

Q34: An option strategy in which you hold

Q39: Which of the following statements is FALSE?<br>A)

Q47: The amount of money raised by the

Q51: Which of the following statements is FALSE?<br>A)

Q58: Suppose that Rearden Metal made a surprise

Q73: If Galt's debt cost of capital is