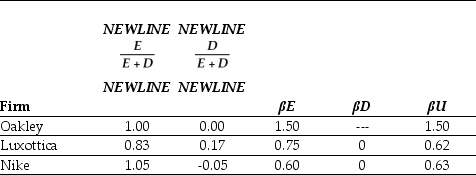

Use the table for the question(s) below.

Capital Structure and Unlevered Beta Estimates for Comparable Firms

-If the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%,then the cost of capital for Nike is closest to:

Definitions:

Driving Ability

A set of skills and capabilities required to operate a vehicle safely, including motor coordination, cognitive comprehension, and adherence to traffic laws.

BAL

Blood Alcohol Level, a measurement of alcohol intoxication for legal and medical purposes.

Small Intestine

A part of the gastrointestinal tract between the stomach and large intestine that absorbs nutrients and minerals from food.

Bloodstream

is the flowing fluid in the circulatory system of the body, through which blood is pumped to carry nutrients, oxygen, and waste products to and from the cells.

Q11: What kind of corporate debt has a

Q12: Which of the following statements is FALSE?<br>A)

Q20: Which of the following is NOT an

Q26: Assume that investors in Google pay a

Q39: Assuming the beta on Taggart stock is

Q45: The total of Rosewood's net income and

Q48: Luther Industries is considering launching a new

Q49: Which of the following statements is FALSE?<br>A)

Q98: Assume that in addition to 1.25 billion

Q107: Suppose that the managers at Rearden Metal