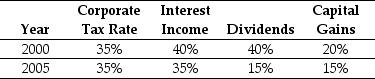

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,the effective tax rate for debt holders was closest to:

Definitions:

Scroll

A roll of paper, parchment, or other material, used in ancient and medieval times for writing documents.

East Asian Literati

A cultural and social movement involving scholars and officials in East Asia who engaged in the arts, poetry, and philosophy, often emphasizing personal expression and the importance of nature.

Watercolor Pigments

The coloring substances used in watercolor painting, known for their ability to dissolve in water and create translucent layers of color.

Ink on Paper

A medium and method of artwork or writing that involves the application of ink onto paper, ranging from calligraphy to sketches.

Q11: Assume that you purchased General Electric Company

Q28: Fill in the table below showing the

Q30: Suppose you are a shareholder in d'Anconia

Q45: Which of the following statements is FALSE?<br>A)

Q46: Which of the following statements is FALSE?<br>A)

Q55: The b<sub>i</sub> in the regression<br>A) measures the

Q83: Assume that management makes a surprise announcement

Q93: Which of the following statements is FALSE?<br>A)

Q94: Which of the following statements is FALSE?<br>A)

Q95: Nielson's EPS if they choose not to