Use the information for the question(s) below.

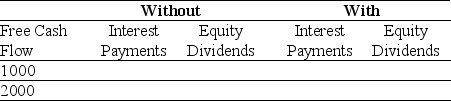

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Leadership Emergence

The process by which individuals become recognized as leaders by their peers or within organizations, often through their actions and qualities.

Masculinity and Leadership

Explores how masculine traits and behaviors influence leadership styles, perceptions, and effectiveness.

Self-Confidence

The belief in one's own abilities, qualities, and judgment.

Self-Confidence

The belief in one's abilities and judgment, promoting a positive view of oneself and one's capacities.

Q21: Assuming that Ideko has a EBITDA multiple

Q27: MJ Enterprises has 50 million shares outstanding

Q31: Two separate firms are considering investing in

Q32: If Flagstaff currently maintains a debt to

Q33: If its managers increase the risk of

Q41: Which of the following statements is FALSE?<br>A)

Q56: Assume that Rockwood is not able to

Q63: Which of the following statements is FALSE?<br>A)

Q86: The unlevered cost of capital for "Eenie"

Q120: The Sharpe ratio for the value stock