Use the following information to answer the question(s) below.

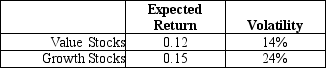

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

State-dependent Learning

A phenomenon where information learned in a particular state of mind is more easily recalled when in the same state.

Self-hypnosis

A technique involving self-induced hypnotic state, often used for therapeutic purposes, stress relief, or personal development.

Dissociative Identity Disorder

A mental disorder characterized by the presence of two or more distinct personality states that control an individual's behavior in different circumstances.

Subpersonalities

Different elements of an individual's personality that may become dominant in different contexts or during various emotional states.

Q17: What is the overall expected payoff to

Q30: Suppose you are a shareholder in d'Anconia

Q31: Luther Industries, a U.S. firm, is considering

Q33: Which of the following statements is FALSE?<br>A)Unlike

Q40: If investors believe that others have superior

Q73: Which of the following statements is FALSE?<br>A)

Q88: Consider an equally weighted portfolio that contains

Q91: Assuming that Tom wants to maintain the

Q104: In an agency problem known as debt

Q131: Suppose that the risk-free rate is 5%