Use the following information to answer the question(s) below.

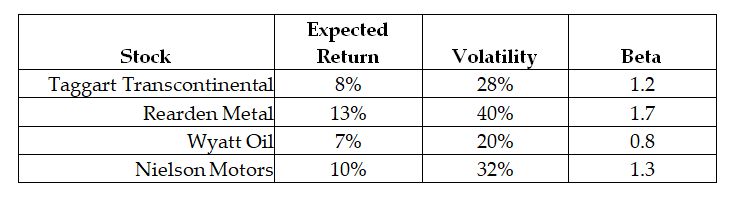

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Taggart Transcontinental is closest to:

Definitions:

Temperature Difference

The variation in temperature between two points, which can drive heat transfer or affect the performance of electrical components.

Primary Cell

A type of electrochemical cell that is designed to be used until the chemical reactions that fuel it are complete and cannot be reversed or recharged.

Secondary Cell

A type of electrical battery that can be recharged after discharge, such as a lithium-ion battery.

LeClanché Cell

An early type of wet cell battery consisting of a zinc anode, a manganese dioxide cathode, and an electrolyte of ammonium chloride.

Q1: Assume that capital markets are perfect except

Q3: The tendency of uninformed individuals to overestimate

Q8: A member of Iota's board of directors

Q36: Which of the following investments offered the

Q42: The expected alpha for Wyatt Oil is

Q45: Which of the following statements is FALSE?<br>A)

Q47: The standard deviation of the overall payoff

Q64: Consider a portfolio consisting of only Microsoft

Q84: Which of the following statements is FALSE?<br>A)

Q92: Following the borrowing of $12 and subsequent