Use the following information to answer the question(s) below.

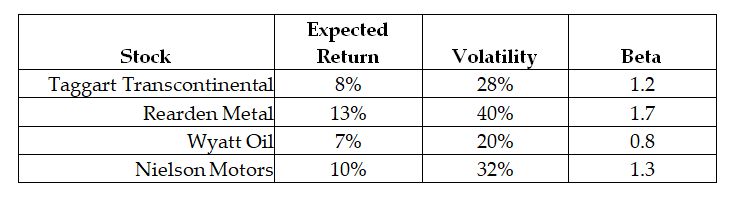

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Wyatt Oil is closest to:

Definitions:

SIP

Session Initiation Protocol (SIP) is a communication protocol used for signaling and controlling multimedia communication sessions including voice and video calls over Internet Protocol (IP) networks.

Nullity

A legal status indicating that something is void and without legal effect from its inception.

Private Causes of Action

Legal rights allowing individuals to sue for a redress or prevention of wrongs, without government intervention.

Environmental Damage

refers to harm or adverse effects caused to the natural environment due to human activities or natural disasters, impacting ecosystems, biodiversity, and human health.

Q9: FBNA's EBIT is closest to:<br>A) $43 million<br>B)

Q20: Using the average historical excess returns for

Q27: Assuming Luther issues a 5:2 stock split,

Q33: Considering the fact that Luther's Cash is

Q58: Using the FFC four factor model and

Q63: Show mathematically that the stock price of

Q78: The Sharpe Ratio for Wyatt Oil is

Q82: The variance of the returns on Stock

Q97: Based upon the three comparable firms, what

Q112: Assuming that the risk-free rate is 4%