Use the table for the question(s) below.

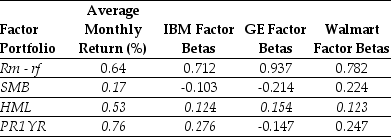

Consider the following information regarding the Fama-French-Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for GE is closest to:

Definitions:

External Financing Needed

The additional funds a company requires from external sources to finance its planned activities or growth when internal cash flows are insufficient.

Profit Margin

A measure of profitability calculated as net income divided by revenues, expressed as a percentage.

Capital Intensity Ratio

A metric that measures the amount of assets required to generate one dollar of revenue; the higher the ratio, the more capital-intensive the business.

Dividend Payout Ratio

The fraction of net earnings a firm pays to its shareholders as dividends, expressed as a percentage of the company’s total net income.

Q21: The cash-and-carry strategy consists of all of

Q21: The effective dividend tax rate in 1999

Q33: Using the available tax information for 2002,

Q56: Which of the following statements is FALSE?<br>A)

Q66: Calculate the correlation between Stock Y's and

Q70: Consider a portfolio consisting of only Duke

Q71: In 2000, assuming an average dividend payout

Q81: Which of the following statements is FALSE?<br>A)

Q82: Which of the following statements is FALSE?<br>A)

Q93: Assume that in the event of default,