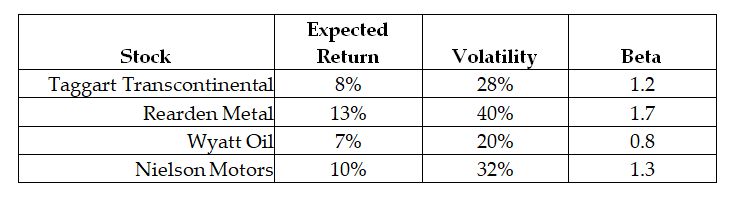

Use the following information to answer the question(s) below.

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-Which of the following stocks represent buying opportunities?

1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Nutritional Status

An evaluation of an individual's dietary intake and nutrient levels, often used to assess and plan dietary needs or interventions.

Mobility Status

An assessment of an individual's ability to move independently or the extent of assistance needed for movement.

Bony Prominence

Areas of the body where bone is close to the skin, which are at higher risk for pressure sores.

Pressure Ulcers

Injuries to skin and underlying tissues, usually over a bony prominence, as a result of prolonged pressure or friction.

Q15: A firm can repurchase shares through a(n)

Q29: The equity cost of capital for "Miney"

Q43: Which of the following stocks represent selling

Q44: The market capitalization for Wal-Mart is closest

Q50: Using the data provided in the table,

Q65: The value of Iota if they use

Q66: Calculate the correlation between Stock Y's and

Q78: The unlevered value of Rose's acquisition is

Q94: What is the excess return for corporate

Q124: The Volatility on Stock X's returns is