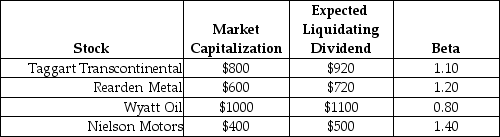

Use the following information to answer the question(s) below.  All amounts are in millions.

All amounts are in millions.

-If the risk-free rate is 3% and the market risk premium is 5%,then the CAPM's predicted expected return for Wyatt Oil is closest to:

Definitions:

Operational Excellence

Involves a firm’s focus on efficient operations and excellent supply chain management.

Market Share

The percentage of an industry's sales that a particular company secures over a specific time period.

Boston Consulting Group (BCG)

A global management consulting firm known for its expertise in business strategy and the development of the BCG matrix.

Portfolio Analysis

An assessment method used by businesses to evaluate the different elements of their product range to optimize strategic decisions.

Q3: Suppose you own 10% of the equity

Q10: Wyatt Oil's average historical excess return is

Q14: A _ is when a rich individual

Q23: Assume that investors hold Google stock in

Q24: The price per share of Iota if

Q34: Your estimate of the asset beta for

Q49: The NPV for this project is closest

Q58: Using the FFC four factor model and

Q60: Which of the following statements is FALSE?<br>A)

Q87: If Rockwood finances their expansion by issuing