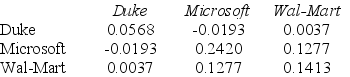

Use the table for the question(s) below.

Consider the following covariances between securities:

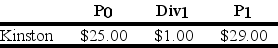

-Suppose you have $10,000 in cash to invest. You decide to sell short $5,000 worth of Kinston stock and invest the proceeds from your short sale, plus your $10,000 into one-year U.S. treasury bills earning 5%. At the end of the year, you decide to liquidate your portfolio. Kinston Industries has the following realized returns:  The return on your portfolio is closest to:

The return on your portfolio is closest to:

Definitions:

Emic

A perspective in anthropology and related fields that emphasizes understanding cultural behaviors and beliefs from within the cultural context itself.

Idiographic

An approach focusing on the individual and understanding the unique aspects of that particular individual.

Quantitative Research

A research method focusing on obtaining data through measurable and typically numeric methods to understand patterns, relationships, or causal effects.

Methodology

A system of methods used in a particular area of study or activity, particularly in research.

Q15: Which of the following statements regarding currency

Q18: If the expected return on the market

Q50: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2720/.jpg" alt="The term

Q61: Rearden Metal has no debt, and maintains

Q63: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2720/.jpg" alt="The term

Q78: Assume that the Wilshire 5000 currently has

Q82: Assume that the corporate tax rate is

Q82: The idea that when a seller has

Q116: The Sharpe Ratio for the market portfolio

Q119: Which of the following statements is FALSE?<br>A)