Use the following information to answer the question(s) below.

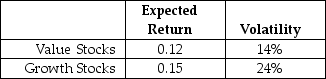

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following statements is FALSE?

Definitions:

Conversion Cost

The total cost of converting raw materials into finished goods, comprising both direct labor costs and manufacturing overhead costs.

Total Conversion Cost

The sum of all labor costs and overhead expenses involved in converting raw materials into finished goods.

First-In, First-Out

An inventory valuation method where goods purchased or produced first are sold or used first.

Conversion Costs

Costs associated with converting raw materials into finished goods, typically including both labor and overhead expenses in manufacturing.

Q2: If Flagstaff currently maintains a .8 debt

Q3: Which of the following statements is FALSE?<br>A)

Q9: The percentage of Wyatt's receivables that are

Q9: Backdating refers to:<br>A)choosing the strike price of

Q18: Using just the return data for 2008,

Q28: KT Enterprises would like to construct and

Q38: The variance on a portfolio that is

Q55: The geometric average annual return on Stock

Q72: The cost of _ is highest for

Q76: Which of the following statements is FALSE?<br>A)