Use the following information to answer the question(s) below.

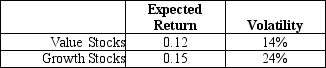

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Personal Self-Efficacy

Refers to an individual's belief in their own capacity to execute behaviors necessary to produce specific performance attainments.

A widely-used social networking platform that allows users to connect, share, and communicate with friends and family online.

Modeling

The process of learning behaviors, attitudes, or emotional reactions through observing others.

Repeating Behavior

Engaging in the same actions or reactions multiple times, often compulsively or habitually, as a way of coping with stress or achieving desired outcomes.

Q15: Which of the following statements is FALSE?<br>A)Similar

Q22: The amount of money that Galt's fund

Q25: Assuming that your firm will purchase insurance,

Q27: What is the excess return for Treasury

Q36: The effective annual rate for Taggart if

Q38: Which of the following questions is FALSE?<br>A)Any

Q56: Which of the following statements is FALSE?<br>A)

Q80: Assume that MM's perfect capital markets conditions

Q84: Assume that the EFT you invested in

Q96: The risk-free rate is closest to:<br>A) 0%<br>B)