Use the following information to answer the question(s) below.

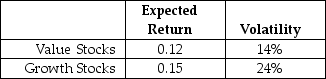

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

Definitions:

Punitive Damages

Monetary compensation awarded to a plaintiff, over and above actual damages, to punish the defendant for egregious behavior and deter future similar acts.

Compensatory Damages

Financial awards to a plaintiff to compensate for proven harm, loss, or injury caused by the defendant.

Nominal Damages

A small amount of money awarded to a plaintiff in a lawsuit to recognize a legal wrong suffered, without substantial loss or injury being proved.

Negligence Per Se

A legal doctrine where an act is considered negligent because it violates a statute or regulation.

Q7: Which of the following equations is INCORRECT?<br>A)

Q12: Farmville Industries is a major agricultural firm

Q14: The correlation between the expected return and

Q15: Which of the following statements is FALSE?<br>A)The

Q16: Using the covered interest parity condition, the

Q24: Which of the following is one unintended

Q32: Your firm purchases goods from its supplier

Q35: Rosewood's net income is closest to:<br>A) $450

Q44: Which of the following agency problems represents

Q49: Suppose that you want to use the