Use the following information to answer the question(s) below.

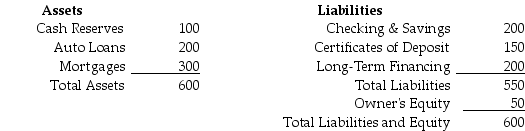

You are a risk manager for Security First Trust Savings and Loan (SFTSL) .SFTSL's balance sheet is as follows (in millions of dollars) :  The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years.Both cash reserves and checking and savings have zero duration.The CDs have a duration of two years and the long-term financing has a ten-year duration.

-If interest rates are currently 5%,but fall to 4%,your estimate of the approximate change in SFTSL equity is closest to:

Definitions:

Energy Saving Device

A device designed to reduce energy consumption without compromising the functionality of the equipment it is attached to.

Original Useful Life

Original Useful Life refers to the expected duration, typically measured in years, during which an asset is considered usable for its intended purpose.

Remaining Book Value

The net amount of an asset or liability recorded on the balance sheet, reflecting original cost adjusted for depreciation, amortization, and impairments.

Salvage Value

The estimated residual value of an asset at the end of its useful life.

Q2: The IRR on the investment of a

Q12: Which of the following statements is FALSE?<br>A)In

Q12: Which one of the following is NOT

Q17: Which of the following statements is FALSE?<br>A)The

Q33: Which of the following statements is FALSE?<br>A)Unlike

Q49: If interest rates are currently 5%, but

Q71: Which of the following statements is FALSE?<br>A)

Q72: If you are interested in creating a

Q81: Which of the following statements is FALSE?<br>A)

Q83: Which firm has the most total risk?<br>A)