Use the table for the question(s)below.

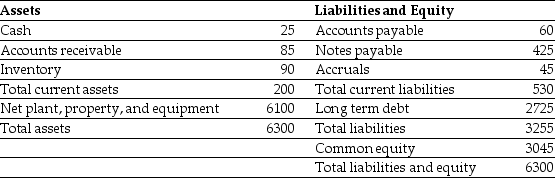

Luther Industries had sales of $980 million and a cost of goods sold of $560 million in 2019.A simplified balance sheet for the firm appears below:

Luther Industries

Balance Sheet

As of December 31,2019

(millions of dollars)

-Calculate the number of days in Luther's Operating Cycle.

Definitions:

Rate Of Return

Profitability or loss incurred from an investment within a fixed period, quantified as a percentage of the investment's buying cost.

Credit Default Swap

A financial derivative allowing an investor to "swap" or offset their credit risk with that of another investor.

CDS

CDS stands for Credit Default Swap, a financial derivative allowing an investor to "swap" or offset their credit risk with that of another investor.

Coupon Bond

A type of bond that offers interest payments through coupons to the bondholder until its maturity, when the principal amount is reimbursed.

Q3: You have decided to buy 10 January

Q5: Using the equivalent annual benefit method, which

Q11: The free cash flow to equity in

Q12: Which of the following statements is FALSE?<br>A)

Q17: What is the excess return for the

Q17: In describing Galt's debt as a put

Q22: Hammond's Euro WACC is closest to:<br>A)7.9%<br>B)8.7%<br>C)10.2%<br>D)12.1%

Q24: If Wyatt adjusts its debt once per

Q31: What is the Yield to Maturity (YTM)on

Q32: The amount that Wyatt Oil pays as