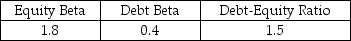

Use theUse the firm has only been listed on the stock exchange for a short time,you do not have an accurate assessment of Nielson's equity beta.However,you do have the following data for another firm in the same industry:  Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

-Nielson's equity cost of capital is closest to:

Definitions:

Multiple Regression Model

A statistical technique used to predict the value of a dependent variable based on the values of two or more independent variables.

Multiple Coefficient

Often refers to the multiple correlation coefficient in statistics, describing the strength and direction of a linear relationship between more than two variables.

Determination

In statistical analysis, it often refers to the extent to which variation in one variable determines or predicts the variation in another variable, commonly assessed with the coefficient of determination (R²).

Observations

Data points or values collected during an experiment or survey.

Q2: Which of the following statements is FALSE?<br>A)When

Q3: Assuming that this project will provide Rearden

Q8: Consider a one-year, at-the-money call option on

Q23: If Flagstaff currently maintains a .8 debt

Q26: If the risk-free rate of interest is

Q30: The amount of money raised by the

Q57: The total debt overhang associated with accepting

Q63: When investors imitate each other's actions, this

Q72: Rearden Metal currently has no debt and

Q79: If Flagstaff currently maintains a debt to