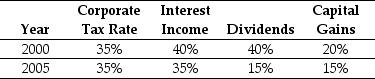

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (τ*) was closest to:

Definitions:

Hypertension

A chronic medical condition where the blood pressure in the arteries is persistently elevated, posing health risks.

False Consensus Effect

The cognitive bias to overestimate how much other people share our beliefs, attitudes, and behaviors.

Conspicuous

Easily seen or noticed; attracting attention.

Drunkenness

A state of intoxication or impairment resulting from the consumption of alcohol.

Q2: The cost of _ is highest for

Q5: Wyatt's annual interest tax shield is closest

Q12: Assume that the corporate tax rate is

Q30: Which of the following statements is FALSE?<br>A)Once

Q40: Which of the following is NOT a

Q47: Using the FFC four factor model and

Q54: Which of the following statements regarding portfolio

Q63: Assume that you own 4000 shares of

Q73: The alpha for Chihuahua is closest to:<br>A)+2%<br>B)-5%<br>C)-3%<br>D)+3%

Q96: If Wyatt Oil distributes the $70 million